MD Comptroller 502B 2024-2026 free printable template

Show details

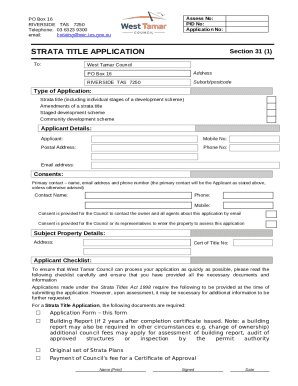

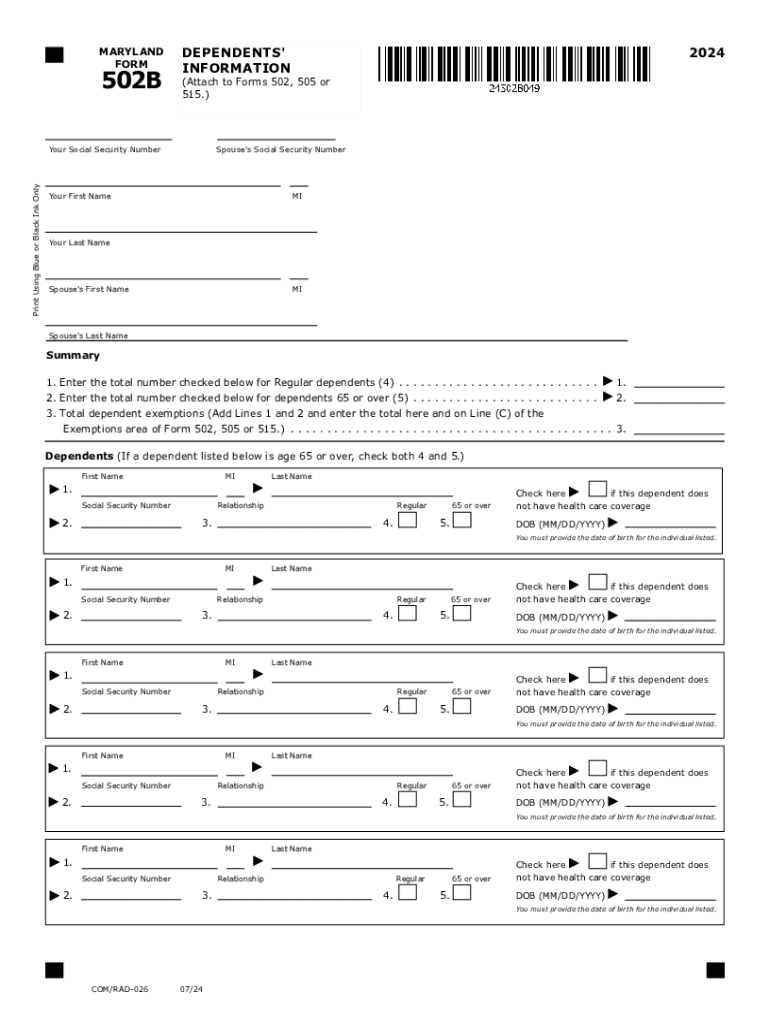

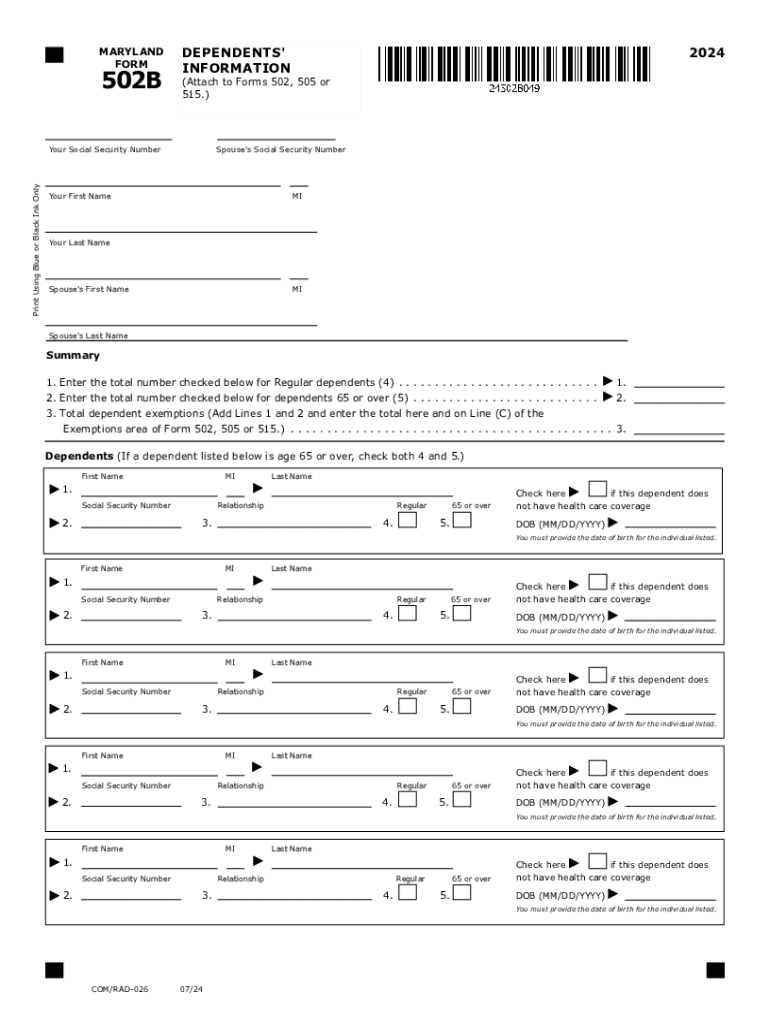

MARYLAND FORM502BYour Social Security NumberPrint Using Blue or Black Ink Only2019Dependents\' Information (Attach to Form 502, 505 or 515.)Spouse\'s Social Security NumberYour First NameMIYour Last

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form 502b

Edit your maryland 502 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your maryland form 502b form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing md form 502 online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit md form 502 b. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MD Comptroller 502B Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 502 form

How to fill out MD Comptroller 502B

01

Obtain the MD Comptroller Form 502B from the official website or your local comptroller's office.

02

Fill in the taxpayer's identification section with the appropriate information such as name, address, and Social Security number.

03

Complete the income section by providing accurate figures from your financial records.

04

Detail any deductions or credits you may be eligible for, following the guidelines provided on the form.

05

Review all entries for accuracy to avoid potential issues with processing.

06

Sign and date the form at the bottom to certify that the information provided is true and correct.

07

Submit the completed form according to the instructions, whether electronically or via mail.

Who needs MD Comptroller 502B?

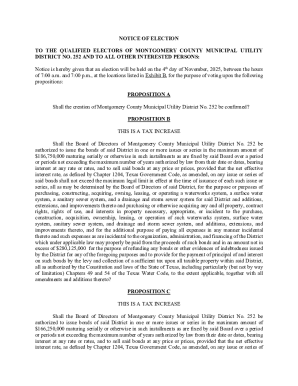

01

Individuals or businesses in Maryland who are required to report specific income or tax obligations.

02

Taxpayers seeking to claim deductions or credits related to their Maryland taxes.

03

Anyone involved in financial activities subject to Maryland tax regulations.

Fill

form 502 maryland

: Try Risk Free

People Also Ask about maryland 502

How much horsepower does an Air Tractor have?

Driving that performance is the Pratt & Whitney PT6A-140AG turboprop engine. It has 867 horsepower available for takeoff all day, every day. The power is yours.502XP Performance. Cruise Speed at 8,000 ft (2.438 m):167 mph (145 kts)Working Speed (Typical):120-140 mph (104-122 kts)6 more rows

Who owns air tractor?

On July 1, 2008 Air Tractor, Inc. became an employee-owned company with the establishment of an Employee Stock Ownership (ESOP) Plan. The ESOP is a tax-deferred retirement plan, similar to a 401(k) plan, except that it is funded solely by the company, not the employees.

How much does an air tractor 502 cost?

AT-502A - PT6-45 ($20,000). MORE Program for PT6A see Conv/Mod section.

How fast can an air tractor go?

AT-802A Performance Cruise Speed at 8,000 ft (2.438 m):191 mph (166 kts)Working Speed (Typical):130-160 mph (113-139 kts)Range - Economy Cruise at 8,000 ft (2.438 m):610 mi (982 km)Stall Speed - Flaps Up:107 mph (92 kts) at 16,000 lbs (7.257 kg)Stall Speed - Flaps Down:91 mph (79 kts) at 16,000 lbs (7.257 kg)3 more rows

Where are air tractors manufactured?

For more than 50 years, the world's best agricultural aircraft have been manufactured in the small west Texas town of Olney: first the Snow, then the Thrush, and since 1972, the Air Tractor.

How much horsepower does an Air Tractor 802 have?

AT-802U Specifications Engine TypePratt & Whitney PT6A-67FEngine maximum continuous shaft horsepower –uninstalled1,600 @ 27.5° C, 1,700 rpmPropeller118 in (300 cm) diameter, aluminum HartzellPropeller ground clearance39 in (0.99 m)Gross weight –landing & takeoff16,000 lbs (7,257 kg)7 more rows

Where is the air tractor factory?

For more than 50 years, the world's best agricultural aircraft have been manufactured in the small west Texas town of Olney: first the Snow, then the Thrush, and since 1972, the Air Tractor.

How much fuel does an Air Tractor burn per hour?

Typical fuel consumption ranges from 58 – 63 GPH, depending on whether Smith is spraying or doing dry work.

How fast can an air tractor go?

A powerful Pratt & Whitney PT6A-67AG turbine engine allows the AT-802F to ferry between the fire and the airfield at speeds approaching 200 mph.

Who makes Air Tractor?

Air Tractor Inc. is a United States aircraft manufacturer based in Olney, Texas. Founded in 1978, the company began manufacturing a new agricultural aircraft derived from the S-2B aircraft (designed by founder Leland Snow's previous company, Snow Aeronautical).

What is the biggest air tractor?

With a payload of 9,249 lbs. (4.195 kg) and an 800-gallon hopper, the AT-802A stands alone. No other single-engine ag plane offers more working capacity.AT-802A Specifications. Engine Type:P&W PT6A-65AGEmpty Weight with Spray Equipment:6,751 lbs (3.062 kg)Useful Load:9,495 lbs (4.306 kg)10 more rows

Who owns Air Tractor?

On July 1, 2008 Air Tractor, Inc. became an employee-owned company with the establishment of an Employee Stock Ownership (ESOP) Plan. The ESOP is a tax-deferred retirement plan, similar to a 401(k) plan, except that it is funded solely by the company, not the employees.

How much does an Air Tractor 502 cost?

AT-502A - PT6-45 ($20,000). MORE Program for PT6A see Conv/Mod section.

How much does a crop duster plane cost?

Crop dusters fly in small planes that cost anywhere from $100,000 to $900,000.

How many air tractors are there?

As of June 2022, Air Tractor has produced 99 planes, and Hirsch said the company has plans to build a record 194 airplanes by year-end.

What engine is in an Air Tractor?

Driving that performance is the Pratt & Whitney PT6A-140AG turboprop engine. It has 867 horsepower available for takeoff all day, every day. The power is yours.

How fast do air tankers fly?

In comparison, most larger air tankers can carry up to 3,000-4,000 gallons of retardant. These aircrafts are often previously passenger jets that can travel near 380 mph. These tankers can be multi-purposed for cargo and military uses.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 502 b form without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your maryland tax form 502 into a dynamic fillable form that you can manage and eSign from anywhere.

How do I edit md 502 form straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing maryland form 502b.

Can I edit maryland tax form on an iOS device?

Create, modify, and share md tax form using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is MD Comptroller 502B?

MD Comptroller 502B is a tax form used for reporting certain types of income and deductions for individuals and businesses in the state of Maryland.

Who is required to file MD Comptroller 502B?

Individuals and entities that have income or deductions that need to be reported for state tax purposes, particularly those related to pass-through entities, are required to file MD Comptroller 502B.

How to fill out MD Comptroller 502B?

To fill out MD Comptroller 502B, gather the necessary financial documents, provide detailed information about income, deductions, and credits, and complete the form according to the instructions provided by the Maryland Comptroller's office.

What is the purpose of MD Comptroller 502B?

The purpose of MD Comptroller 502B is to allow Maryland residents and businesses to report specific types of income and claim related deductions for accurate state tax assessment.

What information must be reported on MD Comptroller 502B?

MD Comptroller 502B requires reporting of income, deductions, credits, and relevant identification information for the taxpayer, including social security numbers and business identification numbers.

Fill out your MD Comptroller 502B online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Maryland Form 502 Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to 502b form

Related to form 502 b

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.