MD Comptroller 502B 2024-2026 free printable template

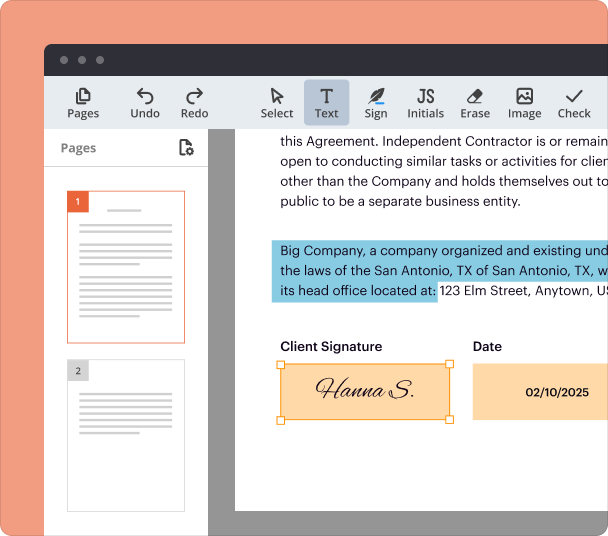

Fill out, sign, and share forms from a single PDF platform

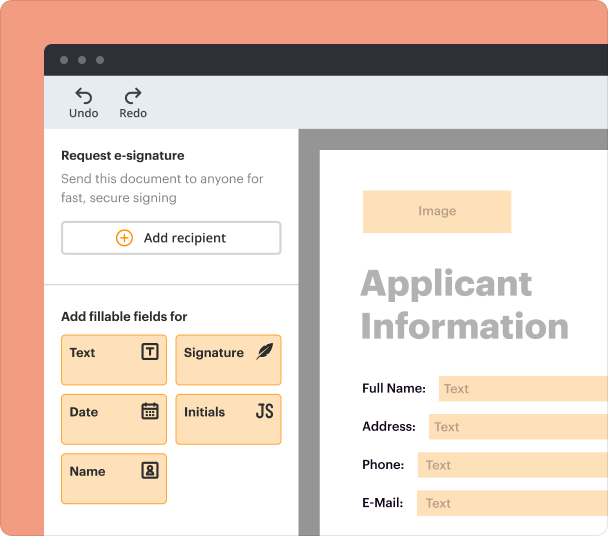

Edit and sign in one place

Create professional forms

Simplify data collection

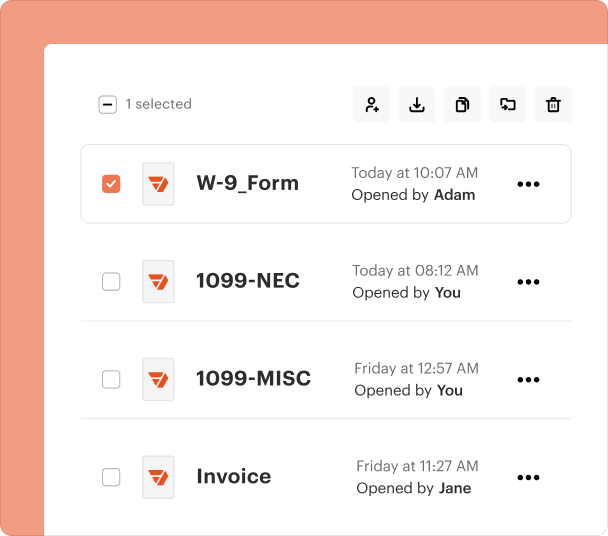

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

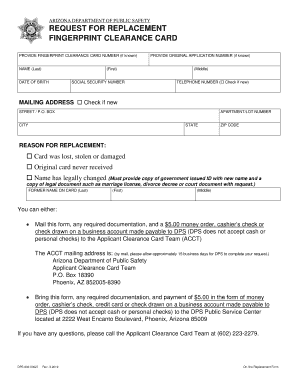

Understanding the Comptroller 502B 2 Form

What is the Comptroller 502B 2 Form?

The MD Comptroller 502B 2 Form is a state tax form used by Maryland residents to report dependents and claim tax exemptions. This form is essential for taxpayers who wish to ensure they receive the appropriate exemptions related to their dependents. It is designed to help the Maryland state government gather necessary information regarding household members that can affect tax calculations.

Key Features of the Comptroller 502B Form

The key features of the MD Comptroller 502B form include sections for personal information, dependent details, and entitlement to exemptions. Each section must be filled accurately, ensuring all dependents are listed along with their Social Security numbers and dates of birth. This form also includes checkboxes to confirm dependent status and health care coverage, which are critical for state tax benefit eligibility.

Who Needs the Comptroller 502B Form?

Primarily, individuals filing tax returns in Maryland who have dependents need the MD Comptroller 502B form. This includes parents or guardians who are legally responsible for minors or qualifying dependents. Understanding who qualifies can impact the completion of tax returns significantly, as the exemptions may reduce tax liability.

How to Fill Out the Comptroller 502B Form

Filling out the MD Comptroller 502B form properly involves several steps. Begin with entering your personal information, including your name, address, and Social Security number. Next, list each dependent's information, including their name, Social Security number, date of birth, and their relationship to you. Be sure to check the appropriate boxes for dependent status and health care coverage, ensuring accuracy to avoid any issues during submission.

Common Errors When Completing the Comptroller 502B Form

Common errors include incorrect Social Security numbers, missing dates of birth, and failing to check appropriate boxes regarding health care coverage. These mistakes can lead to complications in the processing of your tax return. To minimize errors, it is advisable to review each section thoroughly before submission, ensuring all information aligns with official documents.

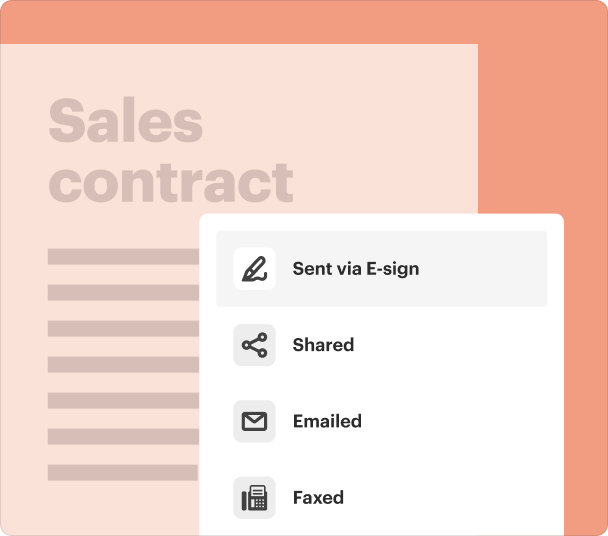

Submission Methods for the Comptroller 502B Form

The completed MD Comptroller 502B form can be submitted alongside your state tax return. It is important to ensure it is included with the appropriate tax forms when filing. Maryland residents are encouraged to use electronic filing methods where possible to streamline the submission process and reduce potential errors.

Frequently Asked Questions about form 502b

What is the purpose of the MD Comptroller 502B form?

The MD Comptroller 502B form is used to report dependents and claim tax exemptions for Maryland residents during tax filing.

How do I obtain the MD Comptroller 502B form?

The MD Comptroller 502B form can be obtained from official Maryland government websites and tax assistance resources, or directly printed from PDF filler platforms.

pdfFiller scores top ratings on review platforms